- July 6, 2017

- Posted by: tpgstaging

- Category: Blog

By: John Wildman, Don Baker and Andy Buteux

DEVIATION from Everyday Price is the single biggest business change we have experienced on the trade side of the consumer products sector in 30-plus years. We regularly see companies spend a large portion of their trade budgets on list price deviations in order to manipulate everyday pricing.

This behavior has two primary root causes. First, there have been concerted recent efforts by many traditionally hi-lo retail companies to match price discounters. These companies today attempt to match or “comp” Walmart pricing, whereas in the past they focused on matching their marketplace competitor.

Second, the commodity upheaval during the latter part of the first decade of 2000 left most companies with inflated list pricing, as price changes were frequent and companies decided to deal back rather than give list price back.

Additionally, we find that consumer marketers seem to spend less time and involvement relative to the equity of the product as expressed through the list price. So we often see 20% to 100% differences in retail everyday pricing when we compare low priced retailers against high priced retailers.

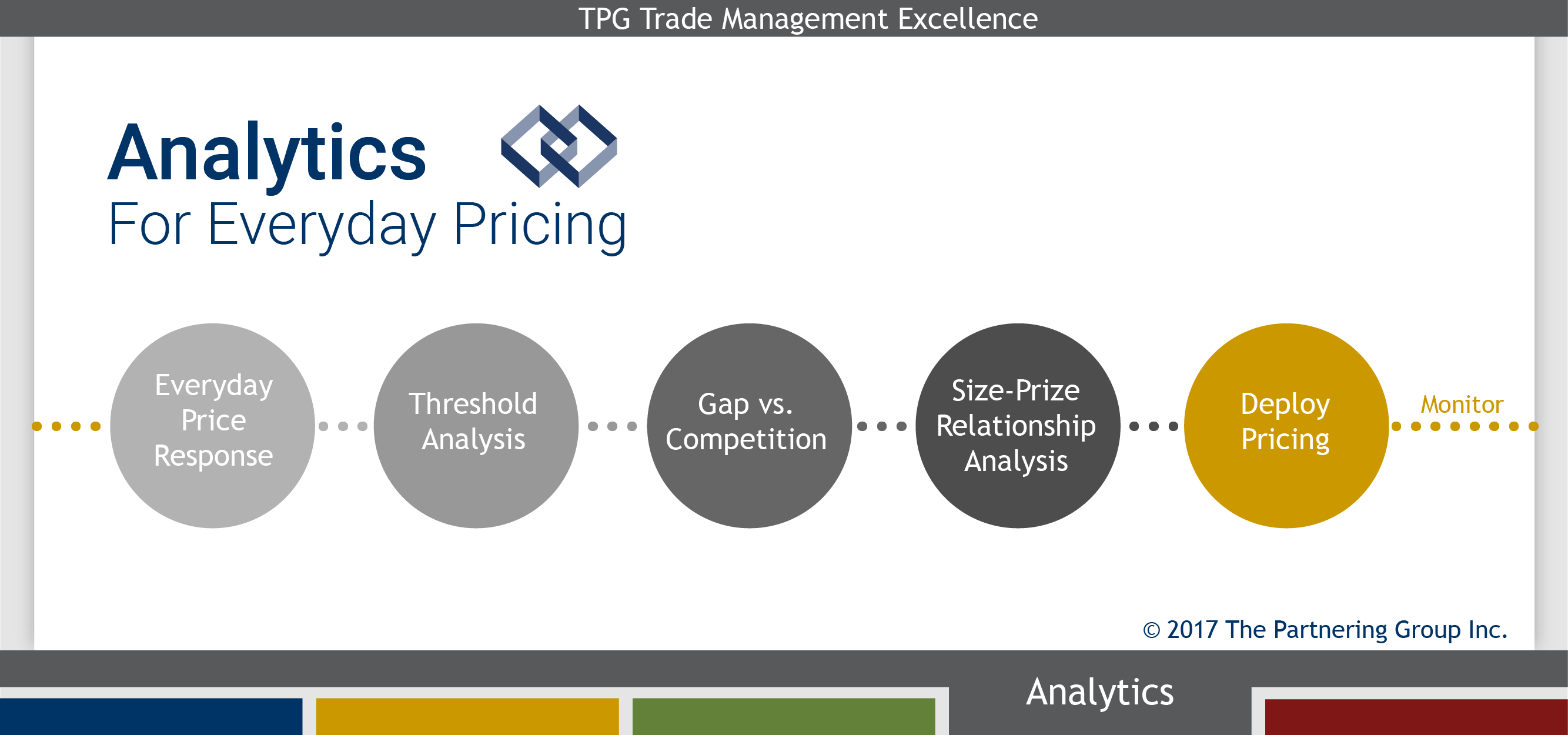

These issues may be successfully addressed by applying a few key practices built around analytic capabilities:

Establish Clear Price Direction – Everything starts with strategy, but many companies can’t articulate their price direction. Start there.

Master Threshold and Gap Management – Price architecture, when properly completed, should provide guidance on key pricing within the portfolio, important thresholds and gaps to competition.

Monitor Pricing Compliance – a regular monthly meeting should be enacted, as suggested in our previous post.

Center Your Analytics Capability in three focus areas: Own price and cross-impact elasticity capability; Gap-to-competition war gaming scenarios; and Portfolio tools to establish cross-item approaches.

Conduct Sales Training – Develop team skills for successful dialogue with your retailers. Curriculum should include: What’s legal and what’s not to discuss. How do we negotiate pricing? How to address common business objections.

To accomplish this successfully, a company needs to apply analytic skills in these three areas:

- Develop a commonly understood way to measure price change impact. What is your ROI approach for measuring everyday price changes?

- Companies should measure retailer impact. Many everyday elasticities I have seen are becoming more inelastic. So payback is tough for the retailer as well. Talk absolute profit, units and revenue during the conversation with retailers.

- Analytics should be regularly deployed against the business to show Business Unit P&L impact. There is a wide array of pricing and margin among retailers in the marketplace. Pricing changes regularly whether you drive it or not. Build a regular cycle to apply price analytics to the marketplace and P&L.

Our most successful engagements have been built more around getting everyday price in line vs. rooting out promotional inefficiency. Spend time to build your everyday price analytic capability. It will pay off!

_________

Author’s Note: This article is the sixth of a TPG series on Trade Management Excellence. Find the previous post here: Compliance – The Elusive Key to Price and Promotion Performance. Next up – Promotion Analysis and Analytics.

© 2017 The Partnering Group, Inc.